Top Social Security login Secrets

Top Social Security login Secrets

Blog Article

The eligibility formulation needs a specified amount of credits (according to earnings) to happen to be gained overall, and a certain number inside the 10 years straight away previous the incapacity, but with extra-lenient provisions for younger workers who come to be disabled right before owning had a chance to compile an extended earnings history.

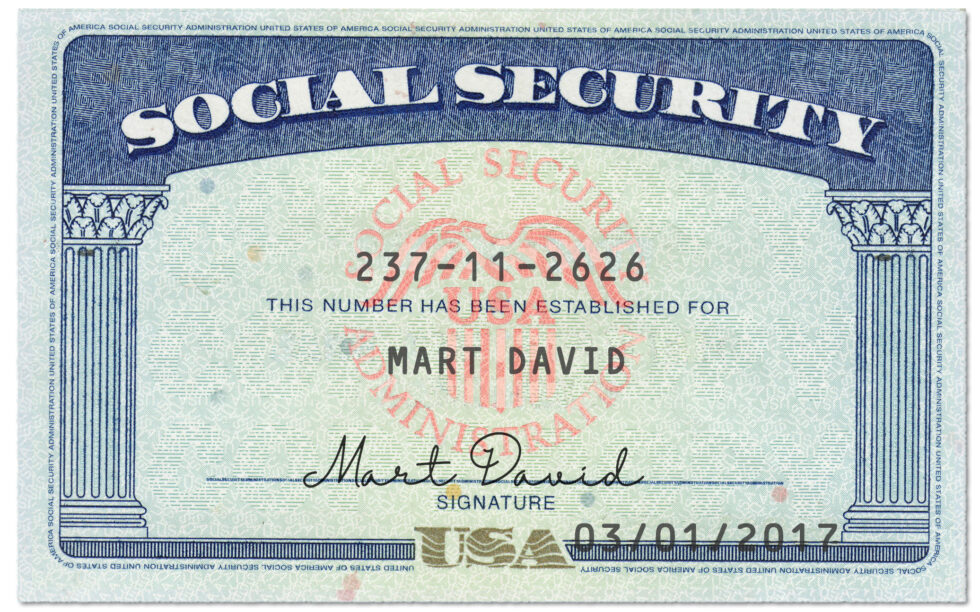

All files submitted needs to be both originals or Accredited copies with the issuing agency. We can not take photocopies or notarized copies of paperwork. You will need evidence of U.S. citizenship and proof of identification to acquire a Social Security Card.

However, Positive aspects are adjusted to generally be drastically more progressive, even though accounting for differences in everyday life expectancy. In accordance with the non-partisan Congressional Spending budget Business, for men and women in The underside fifth of your earnings distribution, the ratio of benefits to taxes is almost 3 times as superior as it is actually for people in the best fifth.[one hundred fifty five]

Federal, state and native employees who may have elected (when they might) NOT to pay for FICA taxes are suitable for your lessened FICA Added benefits and full Medicare coverage if they have got over forty quarters of qualifying Social Security protected function. To reduce the Social Security payments to anyone who has not contributed to FICA for 35+ several years and they are eligible for federal, point out and native Added benefits, which are frequently far more generous, the U.

A sole proprietor and officers of a corporation and administrators of an LLC may be held personally chargeable for non-payment of your money tax and social security taxes whether really gathered from the worker.[121]

Dependant upon your circumstance, you might be able to apply for a alternative card on line. Solution some questions on yourself, and we are going to tell you about The simplest way to make your request.

You'll be able to implement approximately four months before you want your retirement Advantages to begin. One example is, if you turn sixty two on December 2, you can begin your benefits as early as December. If you want your Gains to start out in December, you may apply in August.

Conversely, the SSN Index option lists all of the probable Social Security Quantities one particular soon after An additional as a list. Indeed, that will be an infinite number of digits and mixtures.

You can check with Social Security to assign check here you a fresh amount less than confined conditions, one example is If you're a victim of domestic violence or determine theft. You could only make an application for a whole new quantity in particular person at a Social Security Office environment. Make contact with your local Business office to schedule an appointment or learn more.

Social Security-linked frauds, Total, are pervasive — fraudsters pose as personnel to try to extract the two cash and useful pinpointing aspects from men and women in a number of evolving schemes.

After you report a fraud, you are giving us with impressive data that we use to tell others, identify traits, refine strategies, and get legal action towards the criminals behind these scam things to do.

We'll ask for specific documents we need to evaluation and system your software. These files could contain:

At the total retirement age, the Social Security Administration reclassifies disabled employees as retired workers but the individual's month to month benefit volume just isn't affected.

Originally the advantages gained by retirees were not taxed as profits. Commencing in tax 12 months 1984, Using the Reagan-period reforms to repair the process's projected insolvency, retirees with incomes around $25,000 (in the case of married folks filing individually who didn't live Together with the partner Anytime in the course of the yr, and for individuals submitting as "solitary"), or with blended incomes in excess of $32,000 (if married filing jointly) or, in read more particular cases, any revenue quantity (if married filing separately through the wife or husband within a year through which the taxpayer lived with the wife or husband at any time) normally saw Element of the retiree benefits subject to federal revenue tax.